Theia Ventures at a Glance

We are an early stage climate tech and circular economy fund based in India.

Welcome to the first edition of Theia Briefing. The word ‘Theia’ derives from the Greek goddess of light, brilliance, and opportunity. We are excited to share the key highlights of our operations since our launch in April 2021. Along with our portfolio snapshots and ecosystem events, we also share our views on what’s new within the climate tech and circular space in India and globally. Happy reading!

Our Portfolio

Over the past year, we made investments into 4 early-stage companies - 3 in climate tech and 1 in a circular economy.

»Climate Tech

1. Probus Smart Things

Energy Efficiency & Smart Grid

Probus operates in the power sector, providing distribution substation analytics through IoT as well as smart meter design for power generation companies using Radio Frequency (RF) mesh technology. The company supplies its hardware and middleware solutions to clients such as Adani Electricity, Adani Solar, and Tata Power. Theia invested in Probus’ Pre-Series A round led by Unicorn India Ventures.

Read more about our Investment

2. Sheru

Electric Mobility & Energy Storage

Sheru is building a distributed energy storage network in India by creating a software layer over EV battery swapping and charging stations. This makes energy storage access virtual, on-demand and pay-per-use for independent power producers and distribution utilities to easily scale and flexibly innovate for bidirectional flow of energy from EVs to the grid and vice-versa. Sheru has raised capital from Micelio Mobility, AdvantEdge, Venture Catalyst, Climate Angels, and Turbostart, and received an R&D grant from Mercedes Benz.

3. EdgeGrid

P2P energy trading marketplace

edgeGrid is an on-demand clean energy cloud platform where users, grid operators, and asset owners can transact and plan demand-response access to electricity. EdgeGrid as a platform brings together discoms, commercial and industrial buildings, and smart metering manufacturers in developing a marketplace for real-time energy trading. Theia invested in edgegrid’s Seed round led by Lightrock India.

Read more about our investment

»Circular Economy

1. Canvaloop

Canvaloop is an alternative fiber company that converts biobased waste fibers into wastage into textile fibers and yarn for garment manufacturers and global fashion brands. The company works with brands such as Arvind Ltd, Levi's, H&M, Target, and Vardhman on hemp, pineapple, and banana fiber and yarn materials. Theia invested in Canvaloop’s pre-seed round along with Social Alpha.

Read more about our investment

Ecosystem Events & Thought Leadership

1. CleanTech in India - A Panel Discussion by CNBC Awaaz

We were invited to participate in a panel discussion on ‘Cleantech in India’, hosted by CNBC Awaaz. While early-stage operators EdgeGrid and Bright Blu discussed their business models, growth strategy, and key challenges, we shared our views on how India is uniquely positioned for entrepreneurial innovation in the climate tech space and how the cross-pollination among different sub-sectors in this industry will help India meet its energy demand.

Read more

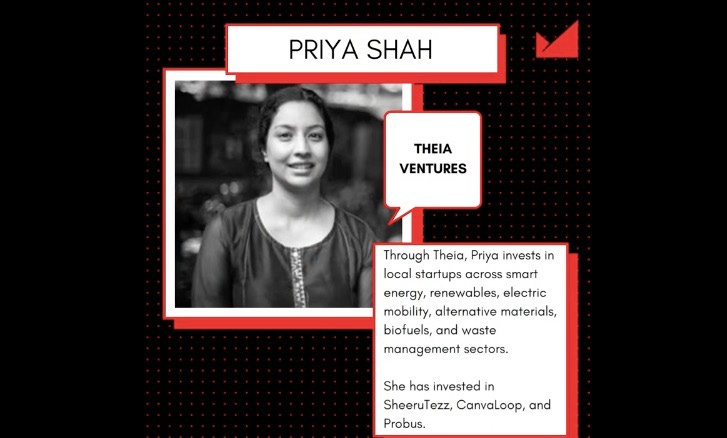

2. Women redefining the climate tech landscape in India

Early-stage investments are key drivers for the climate tech startup ecosystem in India, and on the occasion of International Women’s Day 2022, Climate Angels featured key women in VC who are helping to grow this movement in India, where Priya Shah (GP of Theia Ventures) was featured.

Read more

3. Climate tech investments gain pace in India by KR Asia

KR Asia, a digital media company focused on delivering content on tech-driven business models in emerging markets featured Theia Ventures in their September 2021 issue on climate tech investments in India.

Read more

What are we reading

1. SaaS companies find a silver lining in climate change - Protocol

Climate SaaS is gaining momentum for companies, banks, and investors due to mandatory carbon emission accounting and disclosures required as per Task Force for Climate-related Financial Disclosures (TCFD).

Read more

2. 14 climate tech investors share their H1 2022 strategies – TechCrunch

Climate Tech is emerging as one of the largest VC opportunities, due to both rapid entrepreneurial innovation and with the climate crisis gaining more urgency as evidenced by the latest IPCC reports. In the last year, the climate tech investments have quadrupled with more than 600 investments totaling over $40 billion.

Read more

3. State of Climate Tech 2021 - PWC

A sharper focus on ESG in private markets, alongside emerging regulations such as European Union’s Sustainable Finance Disclosure Regulation (SFDR), is driving growth and leading many companies and investors to alter their investment strategies.

Read more

4. Women shaping the future of climate action, finance, and ESG - Greenbiz Podcast

A podcast by Greenbiz celebrates International Women's Day 2022 and features a list of 25 women shaping climate action globally and why sustainability as a movement will be a breakthrough for women in leadership.

Listen here

5. Democratizing Sustainability to Build Accessibility for Carbon Removal Technologies - Techstars Podcast

A podcast featuring Shopify’s director of sustainability fund which makes an annual commitment of $5 million towards entrepreneurial breakthrough technologies and companies to advance sustainability.

Listen here

Top reads from our Blog

1. Building Distributed Energy Resources - Why we invested in EdgeGrid

EdgeGrid is a distributed energy resources platform, which works with the last mile consumers, primarily commercial and industrial buildings to provide demand response solutions to promote energy efficiency and clean grid solutions. Read more

2. Why we Invested in Canvaloop - The case for Hemp as a textile fiber

As early investors, we're proud to be a part of Canvaloop Fibre's onward journey to grow their footprint in the hemp textiles space. Here's why we decided to invest in Canvaloop and build further on our thesis in circular economy. Read more

3. Hydrogen: The Key to Achieving Net-Zero Emissions?

Our take on hydrogen as the fuel of the future, and the pivotal role it could play in energy transition, both for industry and mobility. Read more

4. Sustainable Textiles: The Case for Bast Fibres in Circular Economy

The textile industry contributes close to 10% of global GHG emissions and about 20% of the global water pollution. How does innovation look like at the biomaterial fibre end of the value chain and what is the uptake of global fashion brands of these new materials? Read more

What’s New at Theia

Himanshu Sharma joined the Theia investment team earlier this year. He brings over 4.5 years of experience in management consulting, banking and government at institutions such as J.P. Morgan, Space2Grow, and the Delhi Legislative Assembly and holds a Bachelor’s degree from Birla Institute of Technology and Science, Pilani.

Shivangi Saxena, who joined our team last year, is now enrolled in the INSEAD MBA program. We wish her all the best in her future endeavors.

Way Forward

Climate tech will be a $3.1 trillion opportunity by 2030 in India. With R&D and deep-tech innovation at their peak, the focus for new early-stage companies is increasingly on scalable solutions to address the climate crisis, in partnership with large, resource-rich corporates, with regulatory tailwinds accelerating this shift. Nevertheless, the sector is in the early stages and there is significant work required to nurture the ecosystem - by startups, incubators, accelerators, angel investors, and funds. We at Theia Ventures are keen to be at the forefront of this revolution and we look forward to providing you with more insights in the months to come - watch this space!

Would you like to learn more about us? Write to us at info@theia-ventures.com