Earth Day, Energy Conference, SF Climate Week and more

As part of our immersion into Earth Day 2023, we were fortunate enough to have had a presence this year at: i) the MIT Energy Conference; ii) the San Francisco Climate Week; and iii) the New York Climate Tech Events. The buzz around these gatherings was remarkable - where the audience ranged from young, aspirational climate activists and those eager to join the sector in new jobs, to experienced founders building breakthrough technology innovations, to savvy investors with sharp theses on the space, to intermediaries who facilitated the knowledge transfer of climate science and data, as well as those accelerators, incubators and fellowship platforms.

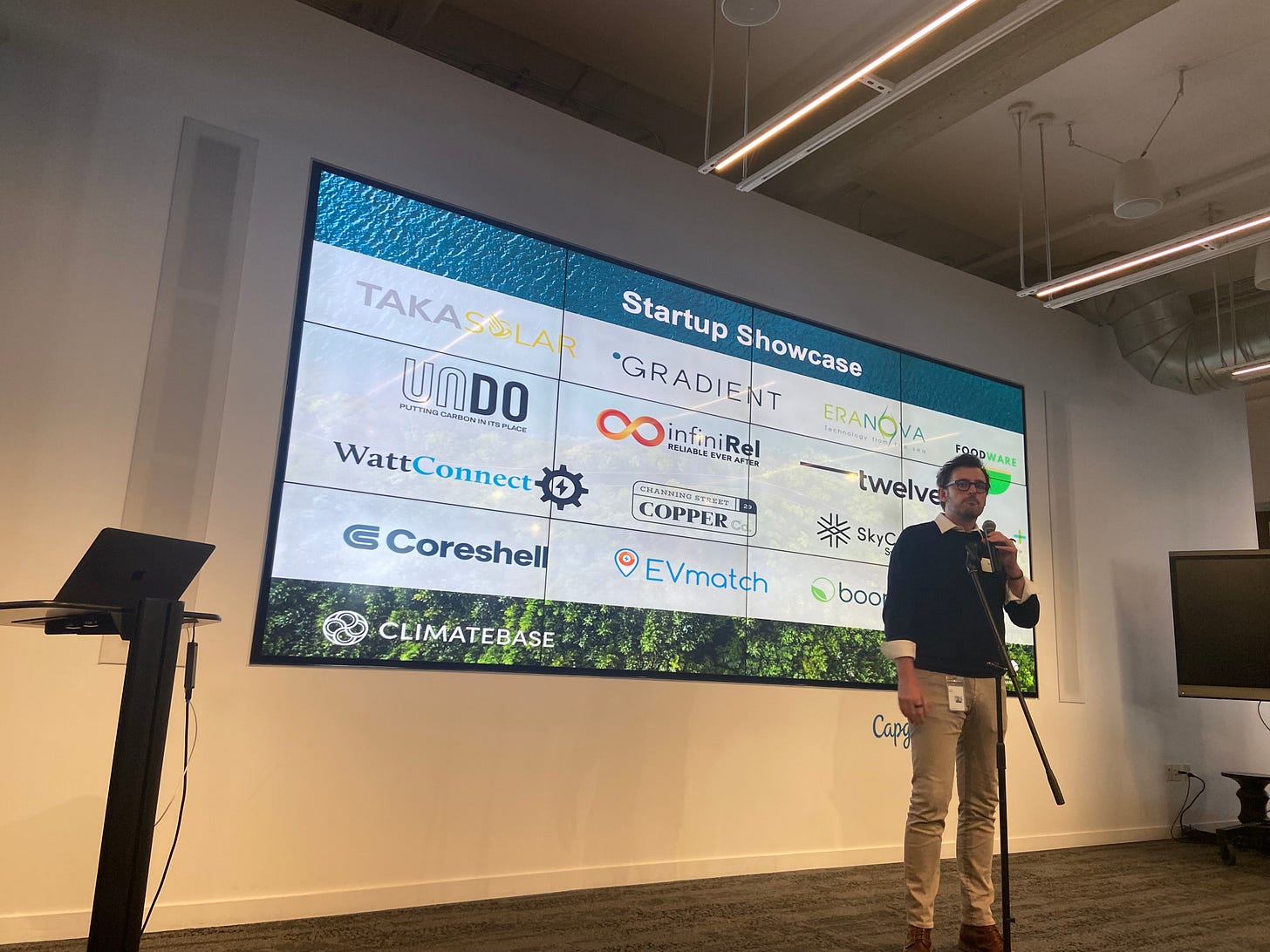

Startup Showcase at San Francisco Climate Week, hosted by Capgemini & Climatebase

In Boston earlier this month, industry leaders, investors, entrepreneurs, students, and policymakers came together discuss the most pressing energy and sustainability challenges at the MIT Energy Conference 2023 held on April 11th and 12th. The themes shone a spotlight on the critical need for international collaboration in reducing global carbon emissions and mitigating the catastrophic impacts of climate change.

Energy security, resiliency, and reliability were intricately woven in all the discussions at the 2-day event with Richard Duke, Deputy Special Envoy for Climate setting the tone by opening the conference with a keynote centered on the United States’ role in the global shift toward cleaner energy. Ditte Juul Jørgensen, Director-General for Energy at the European Commission, discussed the EU's shift in energy policies after the Russian invasion of Ukraine. Juan Carlos Jobet, Chile's former Ministry of Energy and Mining, dismissed the arguments of self-sufficiency and dependence on trade partners, calling them misguided. Jobet emphasized that a third of the world's energy output is generated in non-democratic countries and excluding them from collective efforts to curb climate change would be detrimental.

The resounding message was clear - building an integrated and diversified global energy system is key to guaranteeing adequate energy supply and grid stability.

Innovation, Investment, and Inclusion: Accelerating the Energy Transition

Discussions on the first day of the MIT Energy conference centered around the way we fuel global trade and how we manufacture the building blocks of future homes. The drive to decarbonize, coupled with the heightened volatility of global energy markets resulting from pandemic disruptions and deepening geopolitical tensions, presents a propitious moment for a handful of nations, most notably India and the US, to leverage their early climate tech innovation advantage into a durable competitive position. This is especially important in light of the recent Bipartisan Infrastructure Law and Investment and Jobs Act (IRA), which is poised to funnel over $800 billion of federal resources in the US towards clean energy and sustainability technologies over the next ten years through an array of financial instruments such as grants, tax credits, loans, and direct federal program spending.

The strategic priorities of businesses and startups have also shifted from solely creating frontier technology backed by risk-taking venture capitalists to addressing the practicalities of global implementation for achieving significant impact.

Funding for clean tech innovators is abundant, with venture capitalists, banks, and governments all looking to curb emissions to meet Paris Agreement goals. Regulation and incentives in Europe are pushing companies to cut emissions, while China continues to dominate the clean economy supply chain. Clean energy investment has finally caught up with fossil fuels globally, marking a turning point in the energy industry. Meanwhile, the US combustion engine vehicle market is unlikely to return to pre-Covid levels. However, this electric future will require a massive increase in the supply of metals such as lithium, cobalt, and nickel, which weren’t that useful in the motorized world of the 20th century but are essential components of today’s EV batteries. Shortages of such rare minerals and metals could drive up the cost of the energy transition — and potentially hold it back.

To avoid a situation where the energy transition addresses one problem but creates another, startups are emerging with innovative solutions to reduce the usage of lithium in battery technologies, and extract metals from old batteries and waste products. Megan O’Conner, the co-founder of Nth cycle, an electroextraction battery recycling company, spoke about their plans to operate a toll model, where customers pay to have their metals recycled and own the end product, a precursor to battery cathodes.

Although still in early stages, these startups hold the potential to have a significant impact on the energy transition. By tackling the challenges related to mining and recycling rare minerals, they can contribute to making clean energy more accessible, affordable, and sustainable.

Making green hydrogen is one thing, moving it to where it needs to go is an entirely different challenge.

Green Hydrogen Panel at the 2023 MIT Energy Conference

Hydrogen being ubiquitous in nature presents a tantalizing solution for hard-to-abate sectors like shipping. Despite its potential versatility, hydrogen has played a small role in the energy transition so far because it is still relatively expensive to make, store, and transport. Moreover, most machines and industries are not adapted to use it. However, major hydrogen subsidies set to kick in from the US climate bill could soon realize its potential to be effective in energy-intensive industries, interseasonal energy storage, and return-to-base vehicle fleets, especially heavy goods vehicles, construction vehicles, and agricultural vehicles.

In a panel discussion on hydrogen technology, Sunita Satyapal of the Department of Energy noted that the agency has been funding hydrogen development since the 1970s. Laura Parkan, VP of Hydrogen Energy at Air Liquide Americas, and other panel members highlighted the maturity of hydrogen technology and the need for further scaling to reduce costs and advance the ecosystem. Supratim Das, a senior associate at Electric Hydrogen, noted that blending green hydrogen with natural gas would be the key to scaling distribution.

Hydrogen is also on track to become globally tradable, with an estimated market value of $500 billion to $1.23 trillion a year by 2050. As the global energy system is on the brink of decentralization, there is a pressing need to develop regional and international energy integration, as well as the integration of diverse hydrogen use cases.

The panel discussion highlighted the necessity of prioritizing large individual energy consumers for the initial development of a hydrogen economy, primarily for energy storage purposes, rather than targeting distributed domestic energy consumers who may be less capable of bearing increased energy prices.

Shell is among the major companies banking on hydrogen. It is collaborating with green hydrogen startup ITM Power, constructing a 20MW hydrogen plant in China, and exploring green hydrogen supply opportunities with Norsk Hydro. Shell's net-zero emissions target by 2050 underscores the crucial decisions required for a fair shift to a net-zero society.

The grid of the future needs to tackle misalignment of incentives, cost-benefit allocation and separate deliverability from reliability.

The smart grid has made impressive strides, drawing substantial investment in cutting-edge infrastructure such as smart metering, distribution automation, and electric vehicle charging. However, much of the heavy lifting lied ahead as incumbents must harness their established customer relationships, resources, and capabilities to expedite the de-risking and scaling of technology solutions in collaboration with new technology providers to truly deliver value to consumers. Moreover, for more than a century, the electrical grid was a one-way street, with current traveling from large centralized power plants to customers. But the advent of rooftop solar, batteries, electric vehicles and the rise of “prosumers”—customers who both consume power and generate it—introduced two-way traffic with new layers of complexity for grid operation.

To complicate things further, the grid must be perfectly balanced, with supply and demand closely matching, or the system will fail. Peter Markussen, Senior Director at Energinet in Denmark, stressed the need for ambitious thinking and flexibility in providing negative electricity pricing to customers as a means of building new transmission. Denmark's success in achieving 60% renewable energy in their system is largely attributed to their efforts to build offshore energy hubs and connect them to offshore winds to create new transmission pathway. While solar and wind will undoubtedly be the stars of the energy transition, new renewables capacity is useless without the infrastructure to transport that clean electricity from where it’s produced to the end user. Grids will also be at the heart of enabling the charging network to accelerate the electric vehicle revolution, scaling up energy storage to complement intermittent renewables, and powering the electrolyzers that split water to produce green hydrogen.

Role of Geothermal and Nuclear in Clean Energy Generation

The Renaissance of geothermal energy is upon us, thanks to R&D breakthroughs made in the oil and gas industry during the shale boom of the last 20 years, which is now being funded by climate philanthropy. While geothermal power currently has a small market share of just 0.5% of the total installed capacity in the US, there are already 43 geothermal plants operating in California alone. Iceland is leading the way, supplying 25% of its electricity production from geothermal energy, while over 90% of the country's citizens heat their homes directly from geothermal. China is also embracing geothermal, with the largest amount of geothermal district heating of any country in the world. Geothermal has the potential to scale significantly, especially if the oil and gas industry drills geothermal wells, with the potential to eliminate energy poverty while creating output.

While nuclear power remains an order of magnitude larger than geothermal, the latter is a viable and effective localized domestic resource for heating and cooling, which is needed for grid stability.

The hottest startups in geothermal are developing technologies for high-temperature sensors, cements, insulated materials, and anti-corrosives, as well as operations and maintenance of wells and reservoirs using CO2 as a critical fuel instead of water.

Built Environment

Cleaning up the carbon-intensive construction industry and reducing energy consumption in buildings emerged as a major point of a discussion at a panel on built environment. The built environment has played a significant role in contributing to the climate crisis, with a widely-shared statistic indicating that approximately 40% of global greenhouse gas emissions are generated by building construction and maintenance.

Creating sustainable buildings globally requires sustainable construction of new buildings in developed countries, retrofitting existing fossil fuel-reliant buildings, and promoting green building technology and financing in fast-growing urban areas of the Global South.

Building on these notions, over 30 startups committed to sustainability and clean energy had the chance to showcase their groundbreaking products, ideas, and solutions, further fueling the momentum toward a more sustainable future.

MIT Climate and Energy Prize

The conference culminated in the final round of the MIT Climate and Energy Prize, an annual competition that awards the winning team a $100,000 non dilutive cash prize, access to mentoring and other resources to all the finalists.

This year’s CEP called for entries in eight categories - energy, food and land use, built environment, transportation, ocean climate solutions, industrial decarbonization and climate management.

Announcement of the winners of the MIT CEP Prize 2023

The three winners each had different area of focus within the carbon removal and climate life sciences sectors. Arbon, a Cambridge-based Carbon Removal Company, won third place for their reusable sorbent that captures CO2 directly from the air in a dry condition and releases CO in wet conditions. Arbon's core technology is based on moisture swing adsorption, which only uses water in the process and has a higher energy efficiency than other direct air capture technologies. The runner-up prize winner, SimonCycle, has developed a plastic upcycling technology based on thermodynamic ring-chain equilibria. Unlike traditional plastic recycling, SimonCycle's technology turns polymer chains into cyclic oligomers through catalyzed transesterification under reactive distillation, which can then be separated and re-polymerized to high polymer chain length through ring-opening polymerization.

The grand prize was awarded to Seia Bio for their self-assembling coating that protects microbes used as fertilizers from processing and storage stresses. Seia Bio's coatings protect microbes from freeze-drying stress, anaerobes from oxygen exposure, and temperature-sensitive strains from high-temperature storage, making it easier to use these microbes as a more sustainable and efficient alternative to chemical fertilizers.

Judging Panels at the MIT CEP Prize, hosted at The Engine

India’s Climate tech Opportunity

India stands at the precipice of an opportunity to revolutionize its approach to climate action. With many climate technologies still in their embryonic stage, India has the potential to outstrip the obsolete systems and embrace state-of-the-art solutions. Electric vehicles, battery storage, renewable energy, carbon capture and sequestration technology, smart grid technology, green steel and cement, smart agriculture, and other climate technologies must be developed and scaled for global deployment.

This is especially crucial, given that numerous conglomerates and financial institutions perceive the climate transition as a once-in-a-lifetime economic opportunity, transcending a mere moral or ethical challenge. For instance, stalwarts such as Shell and BP have recognized the need to shift towards the clean-energy or renewables-driven global economy and are pouring in billions into clean technology sectors. Similarly, Indian behemoths such as Reliance, Adani, and Tata are steering towards electric vehicles and green hydrogen, amongst other cutting-edge technologies.

Neil Brown, Managing Director, Global Institute & Infrastructure at KKR, noted during the panel on Energy Policy, Institutional Investment and Asset Management - many emerging and frontier markets struggle to attract capital for clean energy projects as the need to balance emission reduction against economic competitiveness takes centre stage however key investors are looking at India, because of the abundance of natural resources and a thriving entrepreneurial ecosystem in the country. Christina Chang, Principal at LowerCarbon Capital, emphasized their fund’s focus on India and the global south as they see non legacy world investments as a huge opportunity to solve hard technological problems that need to be scaled globally.

This Earth Day, we remain certain that the climate tech sector's imminent game-changers are deeply rooted in cutting-edge physics, chemistry and biotech innovations that address carbon removal and emission reduction.

This would mean that venture investing in this sector would need a new investment strategy centred around ‘hard tech’, and a large scale deployment of catalytic, blended capital. For example, Bill Gates’s $2 billion Breakthrough Energy Ventures fund invests on 20-year cycles, MIT’s "tough tech" incubator, The Engine, assumes it will not see a return for 12 to 18 years, and Prime Coalition began using philanthropic capital to invest in cleantech startups. There are plenty of tried-and-true solutions that can begin to address climate change right now: electric vehicles are coming to the mainstream, and new technologies are helping companies overhaul every fossil fuel-fired stitch in the fabric of society. But as we knock out the easy wins, we’ll also need to get creative to tackle harder-to-solve sectors and reach net-zero emissions.