Celestial Catalysts: Empowering climate solutions through space technology

The race for space is reigniting, and with the climate clock ticking, emerging Space-for-Earth solutions are poised to be pivotal in tackling the climate crisis.

Climate change poses one of humanity’s greatest challenges. A warmer earth is leading to altered weather patterns, rising sea levels, and profound effects on natural ecosystems. However, our understanding of the systemic nature of the impact of climate change, and its interlinkages with various elements of earth is still evolving. Space technology is emerging as a crucial component in climate mitigation and the development of adaptive, resilient pathways toward sustainable development.

While historically driven by government and defence organisations, the space-tech landscape is undergoing a transformative shift with a significant influx of private-sector investments. According to PwC, the global space sector is expected to grow at 11% per annum to reach a $ 1 trillion mark by 2030. The allure of space technology for private investors can be attributed to enabling policies, cost reductions spurred by technological innovations, and an increasingly participatory private sector.

Governments globally are actively fostering private sector engagement in space endeavours. Key initiatives, including NASA's Commercial Orbital Transportation Services program (initiated in 2006), the UK's launch of the National Space Strategy in 2021, and India's Space Policy of 2023 to let private enterprises carry out end-to-end activities from launching satellites and rockets to operating Earth stations, underscore this momentum. Further, innovations in rocket production, microelectronics, reusability, and satellite miniaturisation, driven by advancements in sensors and software are significantly contributing to the evolving landscape. Projections by the Citigroup suggest that launch costs could plummet to $100/kg by 2040, with SpaceX setting an ambitious target of $10/kg. Moreover, private investment in companies related to space exceeded $10 billion in 2021, marking an almost tenfold surge over the last ten years, as reported by McKinsey.

A noteworthy 80% of investments in the space sector throughout 2022 were spearheaded by venture capital firms, resulting in over 1,000 deals since 2015, signifying the accelerating trend of private capital inflow.

Earth Observation

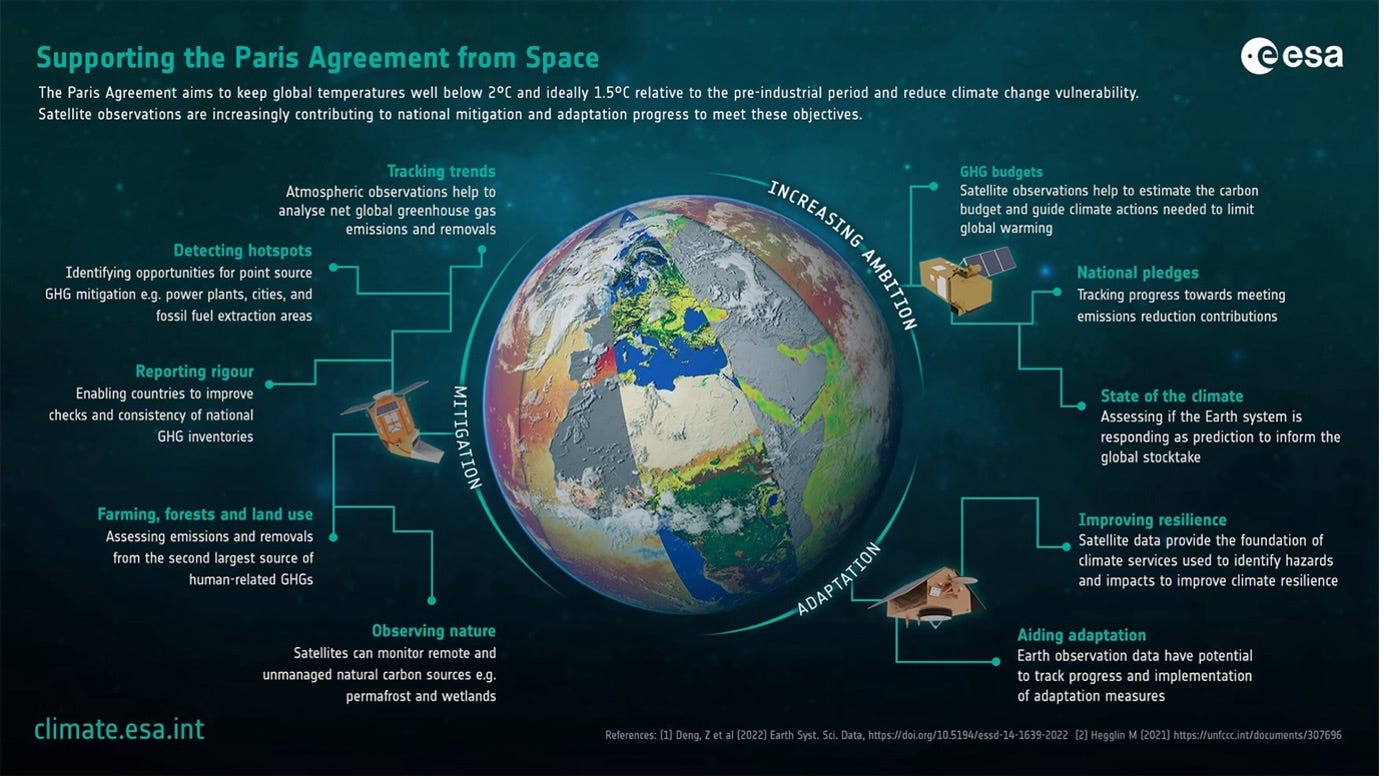

Space technologies, particularly Earth observation (EO), can help deepen our understanding of climate change's effects. According to European Space Agency, “EO is defined as the process of acquiring observations of the Earth’s surface and atmosphere via remote sensing instruments”. The Global Climate Observation System (GCOS) currently specifies 55 Essential Climate Variables for earth’s climate, of which about 60% are measurable only from space. Around 99% of the accurate weather forecasts are enabled by space technology. Figure 1 below shows the various use-cases for EO.

According to Global Climate Observation System (GCOS), “An Essential Climate Variable (ECV) is a physical, chemical, or biological variable or a group of linked variables that critically contributes to the characterisation of Earth’ s climate.”.

The growing urgency for climate action along with policy push is enabling multiple use-cases for EO. For example, the growth of ESG and sustainability reporting requirements across sectors has also led to multiple key clients for such EO data, including corporate firms, consulting agencies, banking and insurance sectors, nature-based project developers, regulators and renewable energy producers.

EO enables up to 30% improvement in the quality of solar energy forecasts. Further, an estimated USD 73 billion of illegal logging, fishing and wildlife trade are preventable using EO.

Exploring key themes at the intersection of space-tech and climate action

I. EO data/ platform companies

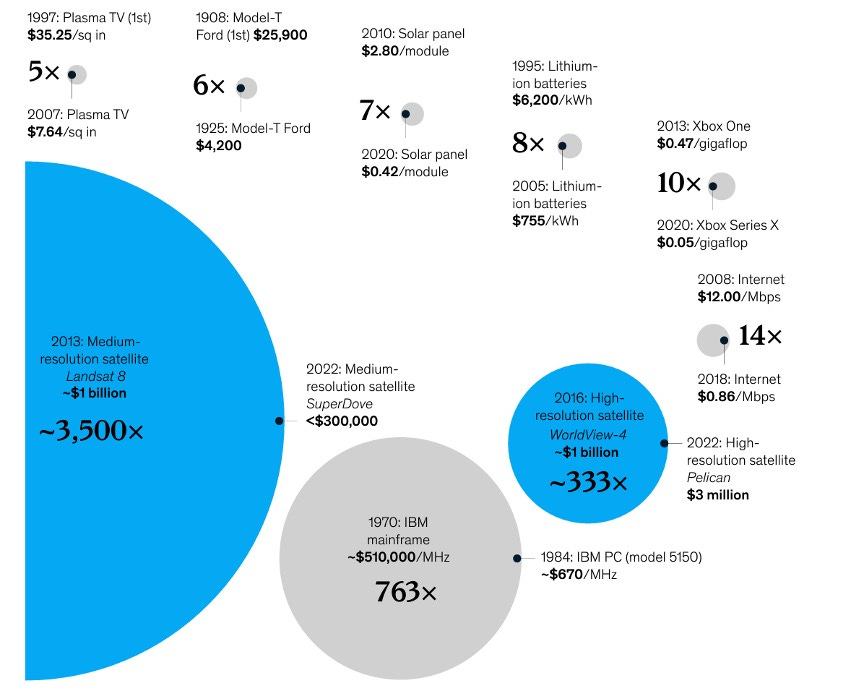

Numerous companies are venturing into launching their satellites, driven by following factors: the existing supply gap in the satellite data market for the emerging commercial use-cases driven by policy requirements; and significant cost reductions in satellite production and operations. Figure 2 presents a comparison for the drastic increase in cost performance over a period of 15 years for the satellites, in comparison with various products/ technologies.

While various Earth Observation (EO) technologies have long been in existence, prominently featured in space-agency-led programs such as Landsat and Copernicus, their data has been more suited for multiple use-cases, providing larger coverage areas instead of asset-level detail, and with data over larger time horizons. Commercial satellites have spurred developments in EO across the following three aspects: i) enhancing the quality and frequency of data; ii) diversifying data through various sensors and iii) targeting specific use-cases.

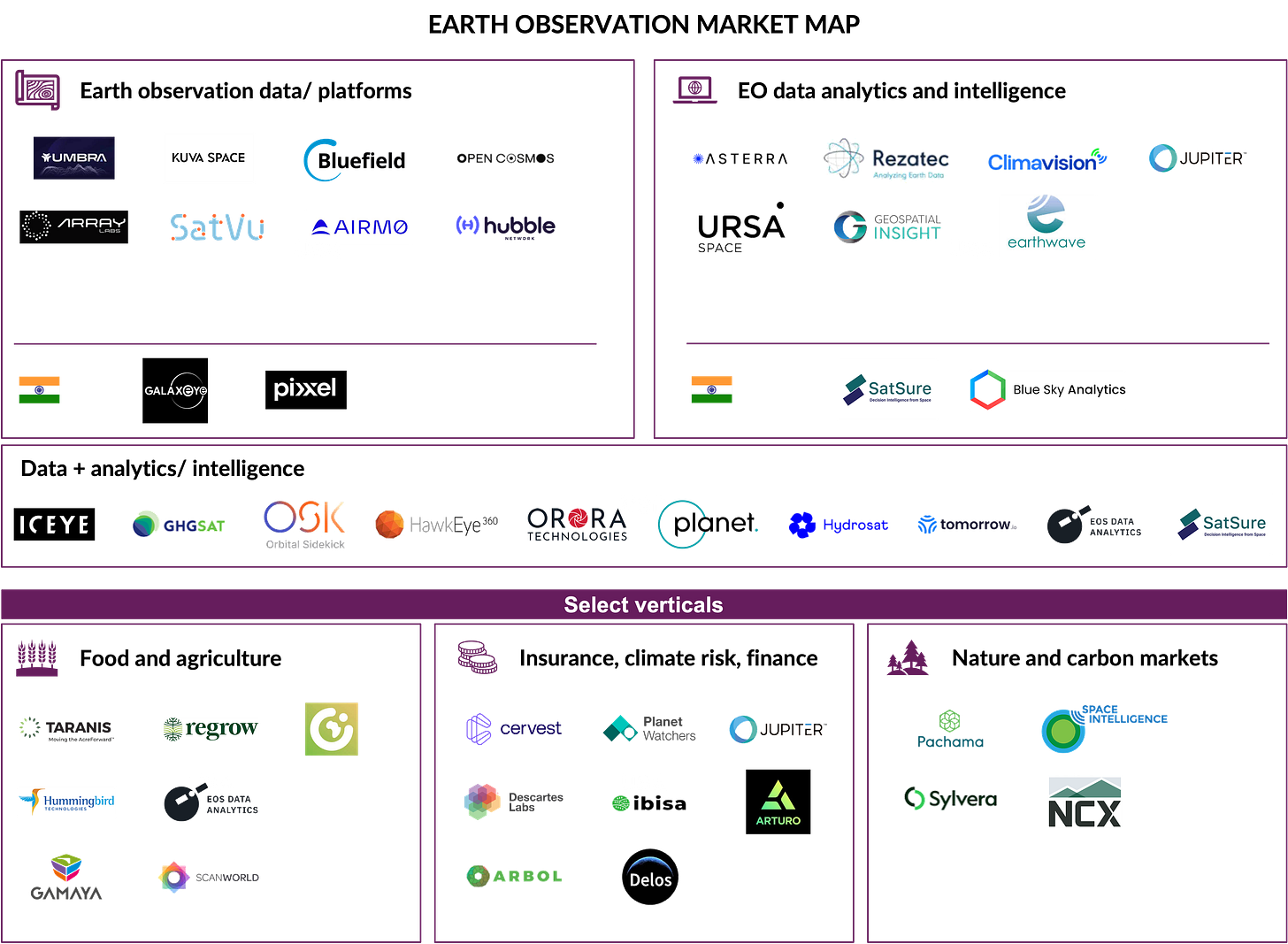

Firstly, modern commercial satellites are enabling gathering of more detailed datasets, such as multiple optical bands or a higher resolution. Additionally, the creation of satellite constellations is enhancing revisit rates and gathering multiple layers of data. For instance, Pixxel, an Indian space data company, is constructing a constellation of hyper-spectral earth imaging satellites, offering targeted monitoring and optimized solutions in various sectors globally. This makes it suitable for segregating unique characteristics that are visible on the Earth’s surface, such as detailed analysis mapping of agricultural crops, analysing forest covers and providing precise surveying for energy and mining companies’ resources. Startups such as Satsure, Vasundhara Geo Technologies and Blue Sky Analytics use hyperspectral imagery in their AI & ML models to develop solutions for natural and climate disaster conditions.

Secondly, commercial satellites are utilising sensors with the ability to capture diverse sets of data. Finland-based Iceye utilises a Synthetic Aperture Radar (SAR) satellite constellation for persistent monitoring, allowing for detection of high-frequency changes and monitoring of natural catastrophic events for the governments and insurance companies. UK-based Satellite Vu captures high-resolution thermal data, offering valuable insights for industries, organisations, and governments toward Net Zero goals. Figure 3 below presents the emerging landscape of commercial satellite companies and the sensors in use by them.

Thirdly, a few commercial satellite companies, as a function of use of specific sensors or capturing diverse characteristics of data, are enabling solutions for specific use-cases. Array Labs in the US is developing a radar satellite constellation for high-resolution 3D imagery, catering to insurance analytics and climate science. Germany-based AIRMO uses micro-LiDAR and spectrometer-equipped satellites to allow corporations to assess their emissions across the global supply chain.

II. EO data analytics and intelligence

The EO business is evolving from an imagery-driven one to insight-driven one. Space Insights-as-a-Service (SIaaS) is rapidly evolving as a concept, which harnesses space-based data and analytics to deliver valuable insights for businesses and governments. According to NSR, Satellite-based Big Data analytics for EO is expected to reach a market of $1.3 billion by 2026, growing at 28.1% CAGR. The key driver to EO data intelligence has been the constant upgrades to computing and big data capabilities, catapulted by the rise in artificial intelligence and machine learning advances over the recent years.

UK-based Climavision offers fast, precise weather forecasting services for various sectors including agriculture, aviation, logistics, energy. It leverages weather prediction models and unique high-resolution observational data sets to fill blind spots in existing forecasts. Israel-based Asterra uses patented algorithm to harness satellites to spot underground leaks in water supplies, providing solutions for water, mining, road and property sectors. SatSure in India leverages advances in satellite remote sensing, machine learning, big data analytics and cloud computing to deliver decision intelligence to agriculture, Banking, Financial Services and Insurance (BFSI), insurance sectors.

EMERGING TRENDS FOR VERTICALLY-INTEGRATED SOLUTIONS

While the commercial EO data and analytics market has been growing, an increasing number of companies are addressing the challenges in data uptake by developing vertically integrated solutions.

A few of the emerging verticals include GHG emissions tracking (e.g. GHGSat), industrial asset management (e.g. OrbitalEye), mining and energy (e.g. KoBoldMetals).

III. EO for Food and Agriculture

EO enables various agriculture use-cases, such as estimating crop yield, pest management, and soil quality monitoring. Results from McKinsey’s annual Digital Farmer Adoption survey show that 29 percent of row-crop farmers and 45 percent of specialty-crop farmers already rely on EO data or plan to do so. EO use for agriculture is currently driven by growing climate stress coupled with the rising pressure on food production needed by year 2050. Precision agriculture in EU itself is expected to be a $4 billion market by 2029, in which EO will play a key role.

UK-based firm Taranis is a precision agriculture intelligence platform, using sophisticated computer vision, data science and deep learning algorithms to effectively monitor fields. Swiss-firm Gamaya offers an agronomic intelligence platform, based on remote sensing and agronomic intelligence, powered by AI and adopted for specific requirements of sugarcane cultivation.

IV. EO for insurance, climate risk and finance

For the insurance sector, EO is enabling insurers to better price and monitor their risk portfolio, and more importantly, to help influence clients’ decisions about their assets, in order to reduce the impact of emerging climate risks. Further, the push towards the adoption of financial and non-financial climate-related disclosures and reporting and use of Science Based Targets (SBT) has given a large boost to geo- spatial climate risk modelling across industries.

UK-based Cervest seeks to help enterprises, financial services companies, and governments quantify climate risk down to the asset level, and across multiple future decades using EO analytics. US-based Delos combines its expertise in wildfire science with climate risk. It uses satellite imagery and artificial intelligence to identify insurable homes within territories deemed too risky by the rest of the insurance market due to growing wildfire risk.

V. EO enabling forestry and carbon markets

Several international conventions and policy frameworks aim to protect and improve the management of natural ecosystem such as forest, wetlands and grasslands. A few of them include policies for Reducing Emissions from Deforestation and Degradation (REDD+), the UN Convention on Biological Diversity (UNCBD), the EU Forest Law Enforcement, Governance and Trade (FLEGT) programme. Further, the Voluntary Carbon Market (VCM) is an emerging market poised for growth but lacks data transparency. The success of this market hinges on the availability of scalable and accurate digital MRV (Monitoring, Reporting & Verification) solutions, as the traditional accreditation process is lengthy, non-digital, and cost intensive.

Harnessing the latest advancements in satellite imagery, remote sensing and machine learning, US-based Pachama measures the carbon stored in forests with precision and monitors forest growth over time, allowing companies identify investable carbon credits. UK-based Sylvera uses satellite images, 3D laser scans and other data to monitor the performance of credits which have already been approved by registries like Verra and Gold Standard.

Looking ahead

In summary, space technology, particularly EO, has formed the early building blocks of resilience infrastructure in tackling the impacts of climate change.

As Figure 4 shows, while new EO satellite companies and constellations emerge, the EO platform business model may see saturation. However, the reduction in costs, driven by competition and data democratization, is poised to fuel the growth of data intelligence. Over time, as specialized products incorporating sector-specific knowledge proliferates, EO as a sector may gravitate towards consolidation and strategic acquisitions. These emerging trends underscore the shift towards companies offering comprehensive, end-to-end vertically integrated solutions. Noteworthy acquisitions in the recent past, such as Constellr and ScanWorld, Planet and Terra Bella, Hydrosat and IrriWatch, serve as compelling examples of this evolving trend.

At Theia Ventures, we firmly believe that the space-tech industry holds immense potential to serve as a fundamental pathway towards developing climate resilient infrastructure. We are excited to support space-tech companies who are at the forefront of this ecosystem and driving these emerging trends.